Starving for Income—Earn around 6% annually from Preferred Stock

Observation From the Investment Boat — Volume 3, Issue 2

By James Mahnke, CIO & Portfolio Manager at GAMMA Investment Management LLC

October 2019

On September 26, 2019, the US Treasury 10-Year was yielding 1.69% and the US aggregate bond market as measured by the iShares Core U.S. Aggregate Bond ETF (AGG) was yielding around 2.66%. For income investors, depending on these low yields to meet living expenses or attempting to build wealth with US inflation around 2%, it is not an understatement to say these rates are starving investors, especially net of inflation. Consider some global rates, such as the Germany Bund 10-Year yield of -0.59%, where, “yes”, investors are paying to hold the investment. Why would investors over the long term pay to have their cash held? That is truly income starvation becoming reality.

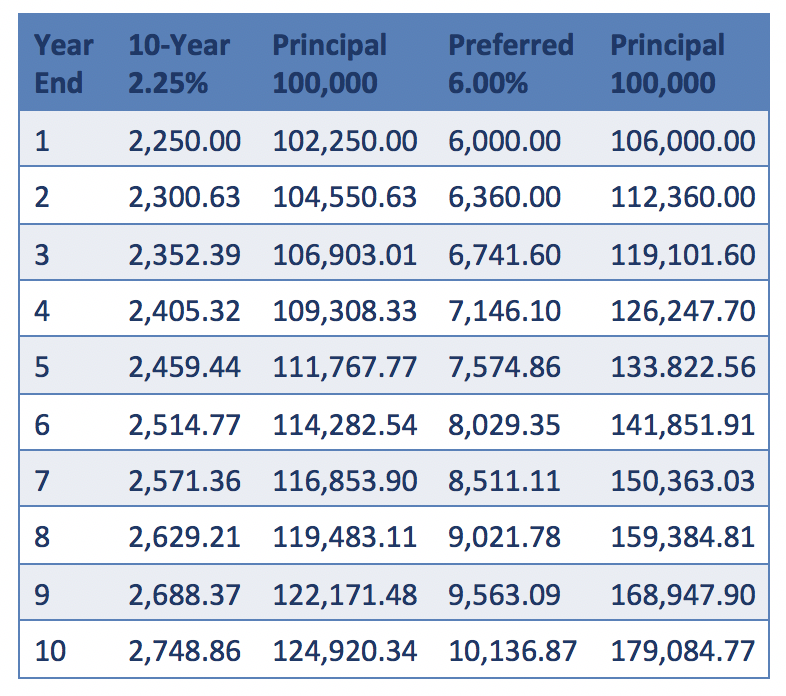

To avoid income starvation, consider selling low yielding fixed-income investments and buying preferred stock. Note the following table showing the benefits of compounding a $100,000 investment at 2.25% versus 6.00% over a 10-year holding period. Assuming stable prices, reinvestment of income and buy-and-hold execution for both investments, the hypothetical 10-Year labeled fixed-income portfolio generates a 24.92% cumulative income return or $24,920.34 over 10 years and the hypothetical Preferred labeled portfolio of preferred stock provides a 79.08% cumulative income return or $79,084.77. Starvation is no longer a consideration with the preferred stock portfolio.

Yet, an assumption of stable prices over 10 years is not a reasonable assumption—especially since negative global rates are hopefully short-term stimulus leading to more economic growth and higher positive rates. As you are aware, when rates rise—bond prices fall. Given the sizable income advantage of the Preferred portfolio, part of the income stream could be used to purchase bona fide hedges to protect against adverse interest rate and credit market moves. Such a combination of preferred stock and hedges not only net boosts your income but adds a layer of protection for achieving a goal of preservation of principal.

The challenge within the preferred market is individual investors are starting to be shut out of the market, as more preferred stock issues are being priced at $1,000 per share (not the traditional $25 per share). More than 80% of the preferred market is now at prices of $1,000 a share or higher and trade over-the-counter at institutional brokerage firms, rather than being listed on exchanges. There are a limited number of mutual funds and ETF’s geared to the preferred market, but almost all of them do not have bona fide hedges protecting against adverse interest and credit market moves. Consider working with an institutional investment advisor that has access to the broad preferred stock market, both over-the-counter and exchange-traded markets, that can tailor a portfolio for you with bona fide hedges.

In sum, the good news is you are no longer likely to be starved for income if you add preferred stock to your investments. The challenge you may face is finding enough preferred stock issues to create a diversified portfolio. Consider hiring an institutional investment advisor that combines preferred stock with bona fide option hedges on those holdings to take advantage of beneficial tax treatment and asymmetrical return patterns. It is those return patterns that create the opportunity to capitalize on market volatility and add more income…allowing you to stay invested without market timing and ride out the market waves in your investment boat.

This information contains forward-looking statements about various economic trends and strategies. You are cautioned that such forward-looking statements are subject to significant business, economic and competitive uncertainties and actual results could be materially different. There are no guarantees associated with any forecast and the opinions stated here are subject to change at any time and by James Mahnke, CIO & Portfolio Manager at GAMMA Investment Management LLC. Data comes from the following sources: Star Tribune, Bloomberg, Yahoo Finance, Wall Street Journal and any other public economic and financial resource deemed to provide relevant information. Data is taken from sources generally believed to be reliable but no guarantee is given to its accuracy.